Top 10 Cap Spending

A look at how the league spends their cap dollars among their top ten salary cap charges.

Numbers! This week we have lots and lots and numbers. I almost fell into the old “paralysis by analysis” trap as I kept adding columns and formulas to the data table.

The goal this week is to examine how NFL teams allocate their salary cap dollars among their top ten individual salary cap charges. Positions were excluded due to the large disparity between veteran and rookie contracts.

Data includes the top ten individual salary cap charges for each team. In this exercise I set out to review how each team compares to each other on total amount, average, top 3, delta from number 1 to number 10, and anything else I could think of. As always the data is courtesy of Overthecap.com.

Reminder: This is cap dollars. Not cash dollars. As I always say, Cash Is King and the salary cap is an accounting function allocation of the cash spent.

Results? We can draw a number of hypothesis and conclusions from the data gathered.

There is an on-going arms race in the west, both in the AFC and NFC, even with Seattle spending a low amount of cap dollars this year.

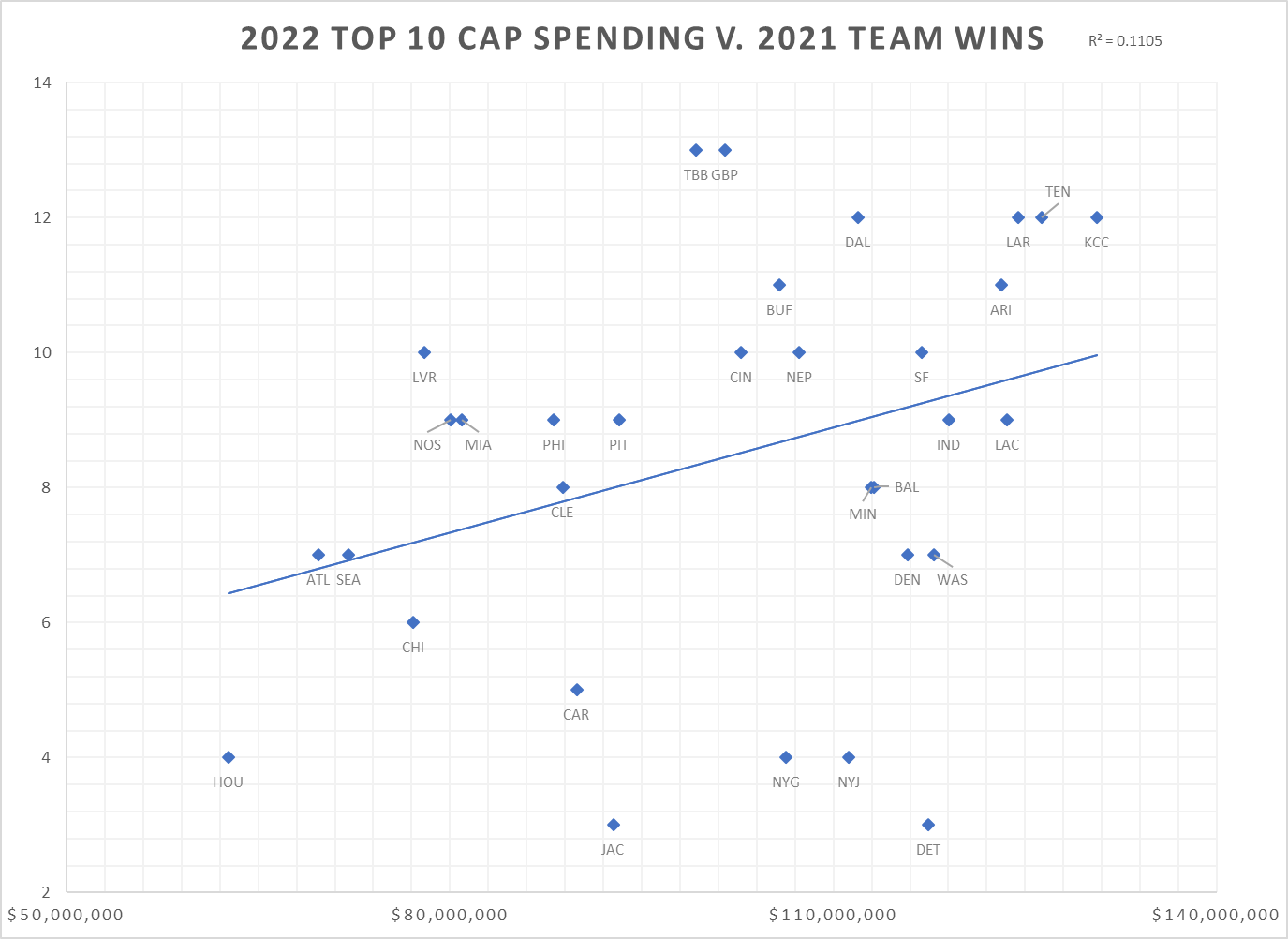

There is a small positive correlation when evaluating cap dollar spending versus team wins from the previous season.

The delta between a team’s #1 salary cap charge and the #10 salary cap charge can give a piece of the puzzle on the team’s salary cap structure.

If we slot these values #1 through #10, the #3 slot has the high average when comparing the maximum value against the average for that slot, at 69.26%.

The Arms Race Out West

The first chart to review is top 10 salary cap spending by division:

No surprise with both of the west divisions leading the way based on the moves made by those teams in the past 3 years. The Chiefs, Rams, Chargers, and Cardinals are in the Top 5 (we will look at that chart soon).

The NFC South, absent Tampa Bay, is a division experiencing a rebuilding and/or retooling situation.

The team that surprised me the most here was Tennessee. Ryan Tannehill ($38.6m), Bud Dupre ($19.2m), and Derrick Henry ($15.0m) comprise Tennessee’s Top 3 spending. One could argue that Derrick Henry is one of the few runningbacks in the league that should be a team’s top 3 salary cap charge.

Another team that surprised me was the Detroit Lions. Despite having Jared Goff on their roster, this is a team still rebuilding the roster left behind by former GM Bob Quinn.

As noted with the teams out west, they occupy 6 of the top 10 spots. Arizona, Los Angeles Chargers are the only teams in the top 10 spots leveraging a rookie quarterback contract. Doing so allows you to replace a top 10 charge with another position.

San Francisco would fall out of the top 10 if a trade with Jimmy Garoppolo occurred.

Teams Spending Cap Dollars After Winning?

If a team has a winning season, do they continue their cap spending to extend the window of wining?

Yes and No. Worth noting this should probably be looked at over many years for a year to year correlation. This is a snap shot of 2022 cap dollars versus 2021 team wins.

There is a small correlation here. The teams that won a lot of games generally continued spending cap dollars. That’s how it should work yes?

You win…keep finding ways to win again. Resigning players, retaining your core, and signing additional free agents to fill in gaps.

Denver and Washington are two teams retooling for 2022. Both teams made big trades for quarterbacks. Washington trading for Carson Wentz and Denver trading for Russell Wilson.

As noted above with my surprise on Detroit, this chart illustrates why given how far below the trend line they are.

One team in a odd location on the chart is the Las Vegas Raiders. The team completed an extension with Derek Carr, and deviated from their cash model structure on the Devante Adams, Maxx Crosby, and Chandler Jones contracts leading them to have a lower top 10 salary cap spend.

Top To Bottom Structure

This subject had the largest disparity between the top and bottom teams on the chart. Here we take a look at the delta between a team’s #1 and #10 charge.

To further explain, the delta (also known as difference) on Tennessee from Ryan Tannehill ($38.6m - #1) to Zach Cunningham ($3.9m - #10) is the $34.6m we see in the chart above.

This can illustrate the overall cap structure of a team showcasing which teams have a top heavy cap structure versus a more even structure. Teams with veteran quarterback contracts generally fall into this category.

Pittsburgh coming in at number 4 is a direct result of TJ Watt’s contract. And the New York Giants…well the former administration did a major disservice to that roster. Joe Schoen has a task in front of him.

To build on this topic, another data point is to look at the percentage of a team’s salary cap used by their top 3 player charges (active roster only, excluding dead money…ahem Atlanta & Houston).

Specific Slot Average

If we assign each rank as a slot, slot 1 through 10, we can look at the average for each slot and compare to the delta as an average. This is not viewed on a team specific basis, merely just the slot value.

The maximum above average on the back end of the top 10 is interesting. When comparing the maximum versus the average across the league, teams are trying to find ways to max out their salary cap structure.

With the amount of restructures and cap saving extensions completed over the past 18 months, there should be no surprise to how this chart came out. Teams are attempting to flatten out their cap structure by pushing a portion of their cap dollars to the future while (again) hedging on a rising league salary cap in the coming years.

What about dead money?

I’m glad you asked. The amount of cap spending a team can be expected to spend correlates to dead money as seen in the chart below. This is to be expected as a team has to remain cap compliant.

With the salary cap in place as dead money rises available cap dollars decreases. Teams looking to rebuild and/or retool will likely have more dead money as their turnover the roster and move on from bad contracts. Philadelphia is the outlier on this chart.

The Eagles are always ahead of the game when it comes to contracts, as we see here they are still able to spend on their top 10 charges even with a considerable amount of dead money. Jalen Hurts’ contract also allows this to occur. Earlier I mentioned replacing the veteran quarterback contract with another position; the Eagles are using dead money as the cap dollar replacement of a veteran quarterback contract.

Closing

With this data we can visualize which teams are the heavy cap dollar spenders and who is pulling back to revamp a roster.

Next week we will take a look at the 3 year cash payout versus APY on the top 15 contracts at each position.

-TC

Top notch analysis. I am a bit surprised at how little Houston spends. I guess that's why the Texans ownership group is happy with Cal. Profits are high.