Three Year Cash Flows vs. APY

Examining player contract three year cash flows compared to the Average Per Year metric of the contract.

Last week I was listening to Jason Fitzgerald’s (who is also my salary cap mentor) OverTheCap Podcast when he mentioned the three year cash flow of Aaron Donald’s 2018 contract extension with the Rams. Paraphrasing a bit, the information stated was Donald had earn more cash (on average) in the three new years of the extension that the contract APY (average per year).

The contract was signed in August 2018. The new contract years started in 2019. The contract stated new money APY was $22.5 million. However Donald had earned $86.89 million through the 2021 league year. That would represent a $28.9 million APY on three years.

While listening to Jason describe this wild fact, I thought to myself…I wonder how often that happens?

To the OverTheCap.com database (website) we go!!

Data

To evaluate this question we need to look at the three year cash flows for the top contracts across the league. I pulled the Top 15, based on stated APY, active contracts at each position across the league, excluding special teams positions. I then removed any contracts that were two years or less in length.

This left us with 160 contracts to use as data points.

The data points used in the review include:

Stated APY (average per year) on contract base value

Three year (3yr) cash flow

Three year APY

Percentage of 3yr cash flow against stated contract APY

This was a quick number developed by Brad Spielberger of PFF, and is a good indicator if a contract is front or back loaded.

Delta of 3yr APY versus stated APY

Total delta of 3yr cash flow versus APY 3yr total

Positions: QB, WR, RB, TE, OT, OG, C, IDL, Edge, CB, and S

Question

Very simple question. On a player contract how many times does the player earn more money in the first three years versus the APY of the contract?

Results

As noted above, our data set includes 160 contracts from the Top 15 contracts among the many position groups. Of those 160 contract, 64 of them came in above 100% of the 3yr APY.

Approximately 40% of the top market contracts are on the over in this study. That is quite surprising to me. Kudos to the player agents who are able to negotiate and secure such contracts.

Maximum: 109% - J.C. Jackson - CB - LAC

Minimum: 80.37% - Davante Adams - WR - LVR

Davante Adams coming in at the bottom after signing a top of the market contract (now 2nd highest) at $28 million APY is quite an achievement. Adams scheduled to earn an average of $22.5m over the first three new money years. For context, Adams is scheduled to earn $72 million total over the final two years of his contract. This is the purest form of back loaded to fluff up an APY. Tyreek Hill has an astronomical final year salary figure to fluff up the stated APY as well.

J.C. Jackson signed a 5 year contract with the Chargers this past offseason as an unrestricted free agent. The contract has a stated APY of $16.5 million, however Jackson’s 3yr cash flow APY is $18.125 million. This number is assisted by the $25 million signing bonus Jackson received.

Next we take a look at the total 3yr cash over the expected amount based on APY.

One position, shockingly, occupies both the top and bottom spots on this chart. The player at the bottom of the chart will surprise many. If you really examined his contract, it would not surprise you.

Maximum: $9.0m - Matthew Stafford (QB - LAR) & Russell Wilson (QB - DEN)

Minimum: -$21.2m - Patrick Mahomes - QB - KCC

This should illustrate has team friendly the front half of Mahomes’ 12 year paper contract is. This contract benefits the team now, and will continue to benefit the team over the coming years as the league salary cap continues to grow.

Russell Wilson landing at the top is no surprise given the heavy up front cash flow Seattle provided in his last extension with the massive $65 million signing bonus at the time of the extension.

Finally we can take a look at this from a team prospective. Who pays the most cash in the first three years of a contract?

As we noted during the last newsletter, the Los Angeles Chargers were heavy into leveraging Justin Herbert’s rookie contract. This chart continues that theme. Los Angeles has offered the strongest cash flow contracts (when summed together) compared to the rest of the league.

Kansas City coming in at the bottom of the chart aligns with the data above on Patrick Mahomes. Travis Kelce is another contract in the negative on 3yr cash flow comparison for Kansas City.

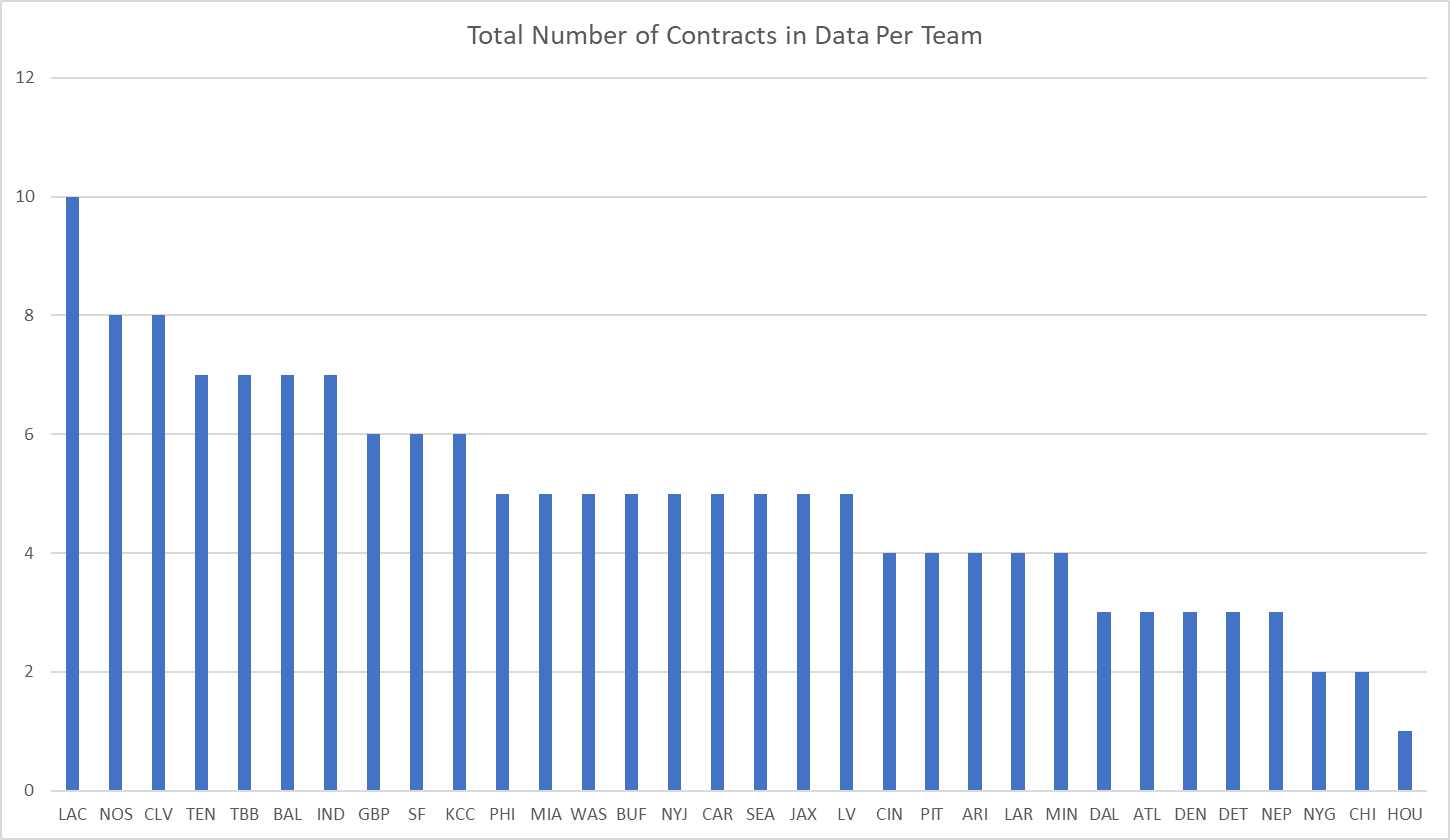

In the event you were curious how many teams had applicable contracts in this data set:

We continue the same theme with Los Angeles Chargers leading the way with 10 contracts out of the 160. Kansas City by contrast, has 6 contracts (in the top third) but has the softest cash flow structure. Beyond Mahomes and Kelce, their four remaining contracts all came in at 100%.

Yes, my Houston Texans barely made the chart. The lone contract is Laremy Tunsil. If we had expanded this to special teams, Houston would have increased to 2.

Final Thoughts

Kansas City has generated team friendly contracts with their veterans on one end of the spectrum. The team has negotiated these structures with their star veterans in an effort to keep their superbowl window open for as long as possible.

The Los Angeles Chargers going crazy with veteran contracts working to leverage the rookie contract with quarterback Justin Herbert. This is a tactic other teams have tried to replicate with moderate success.

40% of the contracts coming in above 100% was unexpected. Of those contracts I should probably have compared contract type. Curious how many of those contracts are unrestricted free agent contracts versus extensions.

I absolutely love the simplicity of the 3yr APY % figure Brad quickly developed. This provides a quick way to measure a contract structure.

Speaking on measuring a contract, our next newsletter will cover how I compare a new contract versus other top market contracts at the same position. We will take a look at the extension for Minkah Fitzpatrick and measure/compare against other top of the market safety contracts to see how each side faired.

Thanks for reading, and don’t forget to share with your friends.

-TC