NFL Middle Class

Taking a look at the middle class of NFL rosters from a salary cap perspective.

Welcome back to a new newsletter, it’s been awhile. I wanted to take a look at the middle class of NFL rosters from a salary cap perspective for the 2022 league year.

This was spurred by a question from a recent podcast. I was diving into roster construction, specifically with Houston, and how the Texans have one of the largest middle classes in the league. Landry (@LandryLocker) asked me to explain that on the podcast. I provided a high level thought on the subject, but I think a slightly deeper dive here was warranted.

Houston running with a large middle class on their roster is a big divergence from past regimes, specifically the Rick Smith era. Rick (and Chris Olsen…call me back Chris) believed in the General Electric (GE) management model of 20/80/10. For a quick reminder, this means 20% of the roster is your core/foundation, 80% is your middle class, and 10% is continued roster churn.

With this model coupled with Houston’s contract structure this led to a top heavy cap spend with the 20% of the roster. Leaving a smaller cap spend on the middle class and roster churn group.

Today’s roster in Houston does not follow that model. I wanted to see how their roster counts compare against the other 31 teams, specifically with the middle class.

Data

We pulled data from Overthecap.com for active cap spending per player across the league. I eliminated practice squad players and some reserve players (NFI, Retired, etc.) leaving only Active players and Injured Reserve players. Many of the players on IR could potential return to their respective roster at some point in the season.

The average salary cap charge, from a percentage perspective, for an NFL player (with the above exceptions removed) was 2.06%. For a cap number perspective, this represents a number of $4.288 million on a $208.2 million league salary cap.

Based on the 2.06% average, we used a grouping of player cap charges ranging from 1.0% to 3.0% the create a middle class of players.

The data was also sorted from Top 25%, Top 50%, and Bottom 25% to see how teams compared here as well.

Results

First let’s take a look at the roster distribution for the Top 25%, Top 50%, and Bottom 25%. Note: this does not cover the entire roster.

This shows the number of players in each cap charge bucket. Our theory of Houston having one of the largest middle classes appears to have some merit based on this chart.

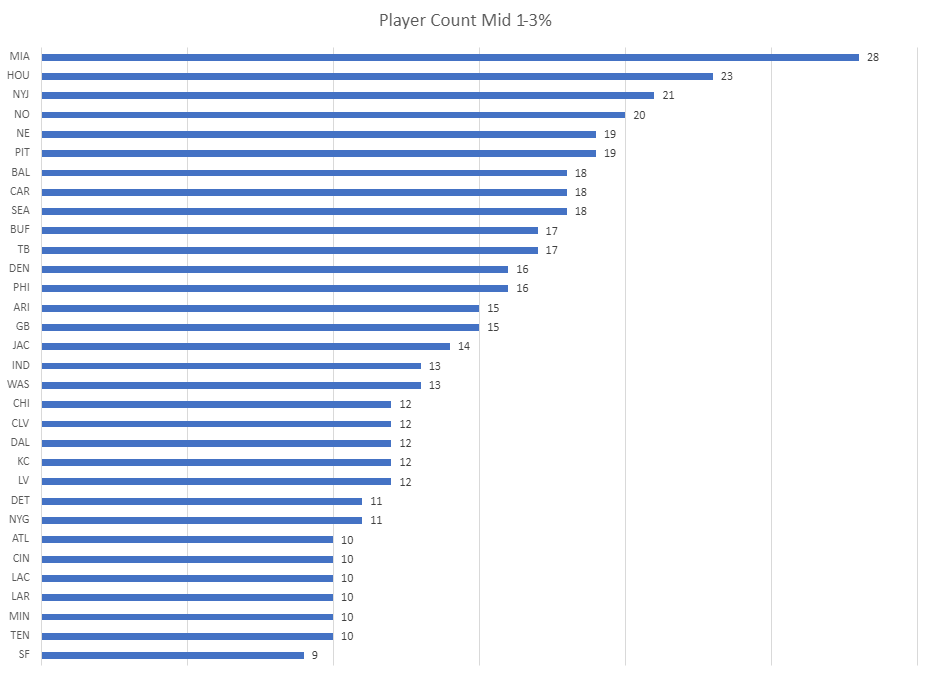

Earlier we discussed creating a middle class based on the average player cap charge across the league. The bucket was created based on a player cap charge of 1.0% to 3.0%. The below chart shows the count of players, per team, that fall into the bucket.

Another prior confirmed by this chart. Houston has the second largest middle class in the league, when using this threshold bucket. Miami topping this chart was a bit of a surprise given how small their Top 50% grouping is compared to the league.

Thoughts

The data confirms the theory that I’ve voiced the past two years. General Manager Nick Caserio has built a large middle class among the 69 player roster.

You are probably asking…is this good or bad? In my opinion the answer is neither. This is just another component of roster building. Caserio was employed by the New England Patriots for nearly 20 years. Many of those years their roster had a similar construction with a large middle class.

I do believe Houston has boxed themselves in a bit due to the contract structure and short term view on the roster. Based on interviews conducted by Nick Caserio, Houston is taking a 1 to 2 year outlook approach to the roster construction.

In today’s league that’s not a bad thing. However the short term contracts signed by Houston the past two years can create an interim problem.

To attract free agents teams will need to offer some version of guaranteed money. When you do that on a one year or two year contract, the guarantee may not be spread out over multiple years. On the flip side with longer term contracts (ex. 3 years) the team takes on more injury liability, more so with aging veterans. It is a fine line to tow regardless.

One thing to note, Houston did incur additional injuries to start the season. This created a situation where roster jumbling was needed during the final 53 man roster cut downs to ensure certain players would be eligible later in the season. Teams have to pay replacement players to cover the injured players. What was supposed to be a 69 player roster (53 + 16 practice squad) turned into a 74 player roster.

Nick Caserio was quoted recently that cap spend for reserve player allotment would be around $16-$18 million. Prior to the Mario Addison activation, that number was around $15.8 million. The injury bug had already pushed Houston to the max with this specific allotment, making things tighter in other areas.

For 2023 and beyond, I suspect we may see Caserio adjust the roster to bring the middle class count down. The percentages will shift to a larger Top 25% and larger Bottom 25% decreasing the middle class.

-TC